Wang Yao, Director, International Institute of Green Finance, Central University of Finance and Economics

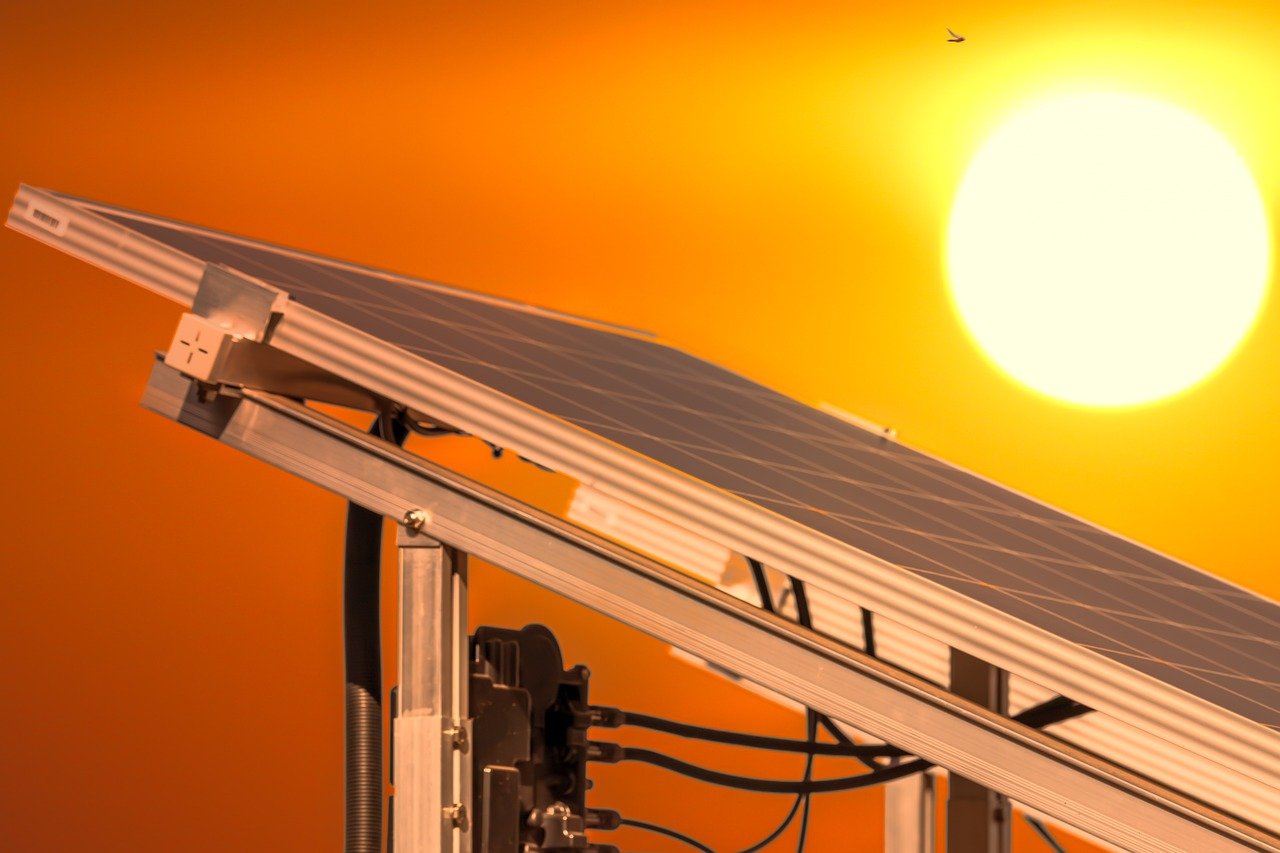

Currently, most funds raised through major financial tools such as green loans and green bonds are directed towards the clean energy industry and the green upgrade of infrastructure. In particular, the photovoltaics and wind power sectors have experienced issues with overheating and intense competition in green funds. It is essential to refine the structure of green financing to fully support projects in new energy, green transportation, green buildings, green manufacturing, and other fields. This will enhance the efficiency of fund and resource utilization.

Renewable energies such as wind and solar power are poised to become the primary sources of energy supply. There are also significant investment opportunities in the development of complementary energy storage technologies such as battery storage and hydrogen energy. Furthermore, the new energy vehicle industry offers promising investment opportunities, with infrastructure development, such as charging stations, battery swapping stations, and hydrogen refueling stations, promoting rapid industry growth. Additionally, the green finance sector itself is poised to emerge as a key investment area, encompassing various aspects that will attract investor attention. As trading expands and the market diversifies, China’s carbon market is expected to provide clearer mechanisms for pricing carbon assets and cost transmission.